Many businesses still choose sites based on gut feeling, a quick drive around the area, or whatever a broker recommends. Some rely on basic spreadsheets with rent, size, and a rough idea of local income levels. On the surface, this looks reasonable. In practice, it leaves big gaps:

- No clear view of who actually lives, works, or moves through the area.

- No idea how far real customers are willing to travel.

- No way to see the impact of nearby competitors or existing branches.

So the decision feels “good” at the time, but once the doors open, reality looks very different. Footfall is lower than expected, delivery routes turn out to be inefficient, or a rival brand nearby pulls demand away. By the time the numbers show the problem, the lease is signed and the fit-out costs are sunk.

This is where site selection needs to change from guesswork to evidence.

In simple terms, site selection is the process of choosing where to open, move, or close a site such as a shop, clinic, warehouse, office, or service centre.

GIS-based site selection uses Geographic Information Systems and spatial analysis to make these choices based on location data, customer patterns, and real-world constraints, not just opinion.

In this article, we will:

- Show how GIS in site selection and spatial analysis help you find high-performing locations.

- Walk through the steps that smart teams use to compare candidate sites in a clear, structured way.

- Answer common questions businesses ask about GIS-based site selection and location intelligence.

- Explain how working with a GIS partner like GIS Navigator can reduce risk when you plan expansions, relocations, or network changes.

If you are responsible for choosing sites, whether for retail stores, clinics, warehouses, or offices, this guide will help you see location decisions in a new light: as a repeatable, data-led process that supports long-term performance, not just short-term activity.

1. What is GIS-Based Site Selection? (And Why It Matters for Your Business)

1. Site Selection in Business Terms

Site selection is the process of deciding where a business should open, expand, relocate, or consolidate its physical sites. It applies to almost every sector that relies on foot traffic, service reach, or efficient movement of goods. Retail brands use site selection to decide where a new store or franchise unit will succeed. Restaurants assess neighbourhood patterns, customer profiles, and access routes before committing to a lease.

Clinics and pharmacies review population needs, travel times, and service gaps to ensure the site will be convenient and sustainable. Warehouses, logistics hubs, and industrial facilities depend on site selection to optimise delivery routes, reduce operational delays, and maintain predictable access to labour and transport networks. Even offices, co-working spaces, and service centres rely on this process to balance accessibility, cost, and long-term growth.

A high-performing location is a site that supports strong demand and offers reliable access for customers, clients, or supply networks. It also enables operations to run smoothly without unnecessary costs or risks. The most successful locations tend to perform well not only in the first few months but continue to deliver stable results over many years. This stability matters because long-term leases, staffing, inventory, and brand growth all depend on choosing a site that meets current needs while supporting future demand.

2. Where GIS Fits In

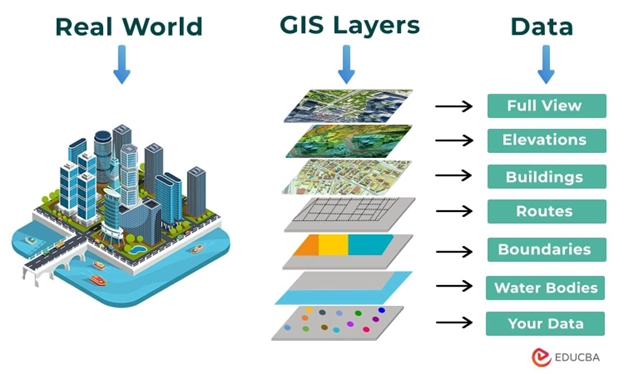

Geographic Information Systems, or GIS, provide a practical way to study how people, places, and patterns behave in real environments. Instead of relying on a single data source, GIS brings many datasets together and shows how they interact across space. Demographic details such as population, age, income, and lifestyle groups help reveal who lives or works near a potential site. Mobility data shows foot traffic, visit frequencies, and travel habits throughout the day. Competitive data highlights where rival stores or nearby complementary businesses are located and how their presence may shape demand. Accessibility data shows travel times by road, public transport, or walking, while infrastructure and regulatory layers reveal zoning limits, land-use rules, environmental risks, and any constraints that could affect long-term operations.

Traditional BI dashboards or spreadsheet analyses offer isolated figures, but they do not show how these variables behave together in a physical environment. GIS adds this missing layer by linking each factor to a location. As a result, businesses can see not only whether demand exists but whether the site can realistically support that demand and avoid risks that might not appear in standard reports.

3. Benefits of GIS-Driven Site Selection

When businesses use GIS to guide their site selection work, the quality of decision-making improves considerably. Forecasts of store or branch performance become more accurate because they reflect real customer behaviour, competitor influence, and the characteristics of the surrounding area. Teams can move faster because GIS helps them filter weak candidates early and focus on locations that meet the required criteria. This reduces the time spent reviewing unsuitable sites and speeds up the overall expansion or relocation process.

GIS also reduces major risks. Businesses avoid overpaying for sites that look attractive but lack true demand. They can review potential cannibalisation across existing locations and ensure that new sites support growth rather than dilute performance. Environmental and regulatory risks become visible before commitments are made, allowing companies to plan with confidence rather than react to late-stage surprises.

2. Why Traditional Site Selection Fails & Common Mistakes We See

1. Relying on “Good Street, Good Intuition” Only

Many businesses still rely on intuition when choosing a site. A busy street, a well-known neighbourhood, or a location that “feels right” may seem like a solid choice at first glance. However, visible activity does not always reflect true demand or customer movement. A street may look busy, but the people passing by might not match the target audience. Brokers often recommend areas based on general appeal or recent deals rather than a detailed assessment of whether the site fits the business model. When decisions are made on gut instinct alone, the result is often unpredictable performance and long-term cost.

2. Ignoring Spatial Relationships

Location decisions fail when businesses overlook how distance, travel habits, and surrounding sites shape customer behaviour. Customers rarely behave in straight lines; they choose routes based on convenience, time, and purpose. Without understanding trade areas and true catchment boundaries, a business may assume that a new site will serve customers from far wider areas than it actually can. Overlaps between existing and new locations may cause one site to weaken the performance of another. Competitors or complementary brands nearby also influence how people choose where to visit, yet this information is often ignored when decisions rely only on static reports.

3. Fragmented or Out-of-Date Data

Static PDFs, outdated census tables, and isolated reports cannot support reliable site selection decisions. Markets change quickly, and consumer behaviour shifts with new roads, public transport routes, housing developments, and economic conditions. When businesses use fragmented data sources, they rarely have a unified view of demand, competition, real estate costs, and operational constraints. As a result, even well-intentioned strategies can be misaligned with current market conditions.

4. No Way to Test “What-If” Scenarios

Another common problem is the inability to compare multiple options in a structured way. Without spatial analysis tools, teams struggle to answer questions such as whether Site A or Site B offers better long-term value, or whether the business should open a new site at all. They cannot easily test different network strategies, such as concentrating on a few large stores versus opening many smaller sites across the region. This lack of scenario testing makes decisions slower and riskier.

GIS and spatial analysis address all these issues by giving businesses a clear, data-led view of the market and the behaviour that shapes performance.

3. How Spatial Analysis Identifies High-Performing Locations

Step 1: Define Your Business Goals and Success Metrics

Every site selection project should begin with a clear understanding of what the organisation wants to achieve. Expansion goals may include opening several new branches within a defined period or improving delivery speed through a new warehouse. Retailers may aim for a minimum sales threshold per site, while clinics may focus on increasing service accessibility. Warehousing teams often prioritise reduced travel times, fuel costs, or better regional coverage.

Success can be measured in different ways depending on the business model. Revenue, operating margin, customer visits, service coverage, or ESG constraints may all play a part. When these success metrics are defined early, the spatial analysis becomes far more relevant because each location is assessed against measurable expectations rather than broad assumptions.

Step 2: Build a Location Intelligence Data Stack

GIS teams begin by assembling all relevant data layers into one environment. On the demand side, this includes population counts, age groups, income levels, lifestyle segments, and B2B prospects. On the supply side, the team evaluates existing branches, competitors, and complementary sites that influence customer choice. Movement data such as foot traffic counts, mobile device activity, traffic volumes, and public transport routes helps reveal how people move across a city or region.

Physical and regulatory layers provide details on zoning, land use, flood risk, environmental constraints, and utility access. Some of this information is available through open sources, while others come from commercial datasets or industry-specific providers. The mix of open and premium data affects the level of detail and accuracy businesses can expect, which is why a data audit is essential before major decisions are made.

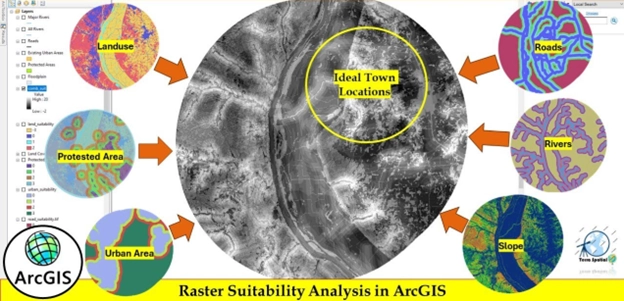

Step 3: Use Spatial Analysis Tools Inside GIS

Once the data stack is ready, GIS analysts apply spatial tools to evaluate each potential site. Drive-time and isochrone maps for drive-time catchments show how far customers can realistically travel in 10, 20 or 30 minutes.. Suitability analysis, often using a weighted overlay, scores each site based on its proximity to customers, transport links, roads, competitors, and constraints. Multi-criteria decision methods help balance conflicting priorities, such as choosing between a location with high demand but limited parking versus one with moderate demand but excellent access.

Similarity analysis is used to identify new areas that share the same characteristics as top-performing existing sites. This is valuable for brands that want to replicate success in new regions. Hotspot and cluster analysis then reveal micro-markets where demand is concentrated or growing, helping decision-makers identify pockets of opportunity they might have otherwise overlooked.

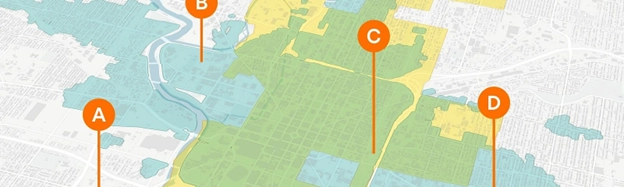

Step 4: Model Scenarios and Rank Candidate Sites

Spatial analysis becomes most useful when businesses compare multiple scenarios side by side. Analysts build scoring models that rank each location from low to high suitability. These models can be adjusted to reflect different strategies, such as aggressive expansion versus more cautious growth. They can prioritise either revenue or reduced cannibalisation. Visual maps and executive dashboards make these comparisons easy to interpret, allowing decision-makers to see the strengths and weaknesses of each option.

Step 5: Ground-Truth and Iterate

Even the best models benefit from on-site validation. Teams visit shortlisted locations to review access, visibility, parking, foot traffic behaviour, and nearby activity that may not appear in datasets. As new performance data comes in from existing sites, analysts refine their models, improving accuracy over time. This feedback loop turns location planning into a repeatable process that becomes stronger with every cycle.

4. Types of Site Selection Problems GIS Can Solve

1. Retail and Restaurants – Finding Profitable Store Locations

Brands can use GIS to understand how GIS supports retail site selection, from demand mapping to competitor impact. Retailers and restaurant operators depend on accurate location decisions more than most sectors. A strong site can create steady sales, reliable foot traffic, and long-term repeat business. GIS helps identify areas where the target audience already lives, works, or moves through daily. Brands can review how far customers are willing to travel for their specific category, which locations may cause cannibalisation, and which neighbourhoods show unmet demand. This level of detail allows retailers to plan expansion waves, refine franchise territories, and avoid investing in areas with limited long-term potential.

Key questions GIS helps answer include:

- Where are my most active customers concentrated?

- How will a new store affect the performance of my existing sites?

- Which neighbourhoods match the profile of my best locations?

2. Healthcare – Clinics, Pharmacies, Diagnostic Centres

Healthcare providers must balance accessibility with operational efficiency. GIS helps identify underserved communities, review travel times, and spot areas with long gaps between services. Clinics can review population age groups, chronic disease indicators (when available), and socio-economic factors that influence demand. Pharmacies and diagnostic centres can evaluate how far patients travel for routine care and identify locations that reduce travel burdens for vulnerable groups.

Typical questions GIS helps address:

- Which communities lack access to essential services?

- Where will a new clinic have the highest impact?

- How do travel times change at different times of day?

3. Logistics & Warehousing – Optimizing Coverage and Cost

Logistics networks depend on predictable coverage, fast delivery windows, and controlled transport costs. GIS helps companies test warehouse locations based on real movement patterns, road networks, and peak congestion times. Businesses can review how different placements affect delivery times, fuel consumption, and vehicle routing. GIS also helps compare micro-fulfilment options, such as dark stores, which depend heavily on precise demand mapping.

Key questions include:

- Which site gives us the best regional coverage?

- How can we reduce delivery times without increasing operational cost?

- What is the ideal number of warehouses to serve a metro area?

Find more details her: Applications of GIS in logistics & supply chain management

4. Industrial & Energy – Land, Risk and Regulations

Industrial and energy projects involve strict regulatory rules and physical constraints. GIS helps evaluate land suitability based on zoning, buffer restrictions, soil type, flood risk, environmental limits, and distance from communities. Renewable energy projects, such as solar or wind farms, depend on land slope, sun exposure, wind conditions, and grid access. GIS provides a structured way to study all these conditions before any site visit or investment.

Typical considerations:

- Does the land meet required safety buffers?

- What environmental risks may affect long-term operations?

- How close is the site to transmission lines or utilities?

5. Public Sector & Economic Development

Public organisations use GIS to prioritise where to build schools, healthcare centres, fire stations, and transport hubs. It also helps economic development teams identify zones that can attract investment or support housing growth. Maps and analysis allow decision-makers to justify proposals to councils, communities, and funding authorities by showing how each location supports service coverage or regional development plans.

5. What Data Do You Actually Need for GIS Site Selection?

1. Core Data Categories

Effective GIS site selection depends on the right mix of data. At the centre is customer and market data, which includes demographics, socio-economic indicators, and demand patterns. Behavioural and mobility data show how people move, where they go during different hours, and how often they visit certain areas. Competitive data highlights nearby rivals and complementary brands that shape customer choice.

Property data, such as rent values, land costs, zoning rules, and parcel boundaries, helps assess viability from a real estate perspective. Risk and constraint layers include environmental risk, flood zones, protected areas, building regulations, and other restrictions that may limit development.

2. Data Quality and Common Pitfalls

Many businesses struggle because they rely on outdated population figures or national averages that don’t reflect local conditions. Some datasets lack details about foot traffic or nearby services that influence demand. Missed POI (point of interest) records can lead to blind spots, especially in retail or healthcare. Without clean and up-to-date data, even the best GIS model will produce inaccurate rankings.

3. Build vs Buy – Where Businesses Get Their Data

Most organisations use a mix of:

- Open data: census tables, government sources, and planning portals.

- Commercial data: mobility datasets, premium demographic segments, retail activity data.

- First-party data: sales history, loyalty records, CRM information, and operational metrics.

First-party data is often the most valuable because it reflects real customer behaviour specific to the brand.

6. How to Start a GIS-Driven Site Selection Project with GIS Navigator

Step 1 – Discovery Workshop

The project begins with a structured discussion to understand the client’s expansion strategy, timelines, and key performance targets. During this session, both sides clarify success metrics such as revenue expectations, delivery speed, or service coverage. The team also reviews any constraints, including budgets, approved regions, or brand guidelines. This helps shape the scope of the analysis and ensures all decisions align with the organisation’s long-term plans.

Step 2 – Data Audit & Feasibility

The next stage is a data audit. GIS Navigator reviews the information the client already has, site lists, sales figures, CRM data, footfall logs, or operational metrics. Any gaps are identified and prioritised. These gaps might include missing competitor data, outdated demographic information, or limited mobility records. Once the full data picture becomes clear, the team evaluates the feasibility of running a complete site selection study.

Step 3 – Pilot Site Selection Study

Most projects begin with a pilot focused on one city, region, or planned expansion wave. This is where GIS Navigator builds suitability maps, ranks potential sites, and tests different scenarios. The deliverables include a set of shortlisted locations, clear scoring criteria, and visual outputs that executives can review without technical knowledge. This pilot stage provides evidence that the approach is reliable before scaling to wider regions.

Step 4 – Scale to a Repeatable Location Strategy

Once the pilot is approved, the method becomes a repeatable framework. GIS Navigator develops a location strategy roadmap covering the next 12–24 months. Businesses can choose ongoing support, periodic analysis, or access to dashboards that show updated patterns as markets change. Over time, this becomes a long-term location intelligence process rather than a one-time exercise.

7. ROI: What Difference Does GIS-Based Site Selection Make?

1. Quantifying the Impact

Businesses that adopt GIS-led site selection often report higher sales per site because new locations better match real demand. They experience fewer closures or relocations because weak candidates are filtered early. Decision timelines become faster because teams can review many options in one model instead of analysing each site separately. These outcomes have been observed across retail, healthcare, logistics, and financial services sectors.

2. Qualitative Benefits

Beyond financial results, GIS supports clear communication between real estate teams, finance, marketing, and operations. It provides visual evidence for decisions, helping leaders present stronger cases to boards, lenders, and investors. Teams gain confidence because each location is backed by clear reasoning rather than intuition alone.

3. Quick Case Snapshot

A well-known retail brand used GIS to evaluate hundreds of potential locations across multiple regions. Through suitability scoring and mobility analysis, they identified a set of high-potential micro-markets they had previously overlooked. The final sites outperformed the chain’s average store sales in their first year. This approach has been documented in public GIS case studies from established providers such as Esri.

8. How to Choose a GIS Partner for Site Selection

Choosing the right partner is essential because location decisions affect long-term performance. Key questions to ask include:

- What industries do you have experience in?

- Can you show examples similar to my business?

- How do you validate your models with real results?

- Who owns the data and analysis at the end of the project?

Warning signs include models that operate as a “black box,” unclear data sources, and no pilot or validation phase. A reliable partner should be transparent about methods and provide clear reasoning for each recommendation.

Conclusion

The success of any physical site, whether a store, clinic, warehouse, or office, depends on choosing the right location. Decisions based on instinct alone often lead to unpredictable results. GIS and spatial analysis replace guesswork with clear evidence, structured comparisons, and reliable forecasts. They turn site selection into a repeatable method that supports long-term business performance.

If you want to reduce risk and make confident decisions about expansion or relocation, GIS Navigator can guide you through the full process, from data audits to suitability scoring and long-term strategy planning. You can reach out anytime to discuss your goals or request a pilot study tailored to your region.